Rational choice theory

| Economics |

|

Economies by region

|

| General categories |

|---|

|

History of economic thought Methodology · Mainstream & heterodox |

| Technical methods |

|

Game theory · Optimization Computational · Econometrics Experimental · National accounting |

| Fields and subfields |

|

Behavioral · Cultural · Evolutionary |

| Lists |

|

Journals · Publications |

| Business and Economics Portal |

Rational choice theory, also known as choice theory or rational action theory, is a framework for understanding and often formally modeling social and economic behavior.[1] It is the main theoretical paradigm in the currently-dominant school of microeconomics. Rationality (here equated with "wanting more rather than less of a good") is widely used as an assumption of the behavior of individuals in microeconomic models and analysis and appears in almost all economics textbook treatments of human decision-making. It is also central to some of modern political science and is used by some scholars in other disciplines such as sociology[2] and philosophy. It is the same as instrumental rationality, which involves seeking the most cost-effective means to achieve a specific goal without reflecting on the worthiness of that goal. Gary Becker was an early proponent of applying rational actor models more widely.[3] He won the 1992 Nobel Memorial Prize in Economic Sciences for his studies of discrimination, crime, and human capital.

The "rationality" described by rational choice theory is different from the colloquial and most philosophical uses of the word. For most people, "rationality" means "sane," "in a thoughtful clear-headed manner," or knowing and doing what's healthy in the long term. Rational choice theory uses a specific and narrower definition of "rationality" simply to mean that an individual acts as if balancing costs against benefits to arrive at action that maximizes personal advantage.[4] For example, this may involve kissing someone, cheating on a test, buying a new dress, or committing murder. In rational choice theory, all decisions, crazy or sane, are postulated as mimicking such a "rational" process.

The practitioners of strict rational choice theory never investigate the origins, nature, or validity of human motivations (why we want what we want) but instead restrict themselves to examining the expression of given and inexplicable wants in specific social or economic environments. That is, they do not examine the biological, psychological, and sociological roots that make people see the benefits encouraging them to kiss another, cheat on a test, use cocaine, or murder someone. Instead, all that is relevant are the costs of doing so—which for crimes, reflects the chance of being caught.

In rational choice theory, these costs are only extrinsic or external to the individual rather than being intrinsic or internal. That is, strict rational choice theory would not see a criminal's self-punishment by inner feelings of remorse, guilt, or shame as relevant to determining the costs of committing a crime. In general, rational choice theory does not address the role of an individual's sense of morals or ethics in decision-making. Thus, economics Nobelist Amartya Sen sees the model of people who follow rational choice model as "rational fools."

Because rational choice theory lacks understanding of consumer motivation, some economists restrict its use to understanding business behavior where goals are usually very clear. As Armen Alchian points out, competition in the market encourages businesses to maximize profits (in order to survive). Because that goal is significantly less vacuous than "maximizing utility" and the like, rational choice theory is apt.

Although models used in rational choice theory are diverse, all assume individuals choose the best action according to unchanging and stable preference functions and constraints facing them. Most models have additional assumptions. Those proponents of rational choice models associated with the Chicago school of economics do not claim that a model's assumptions are a full description of reality, only that good models can aid reasoning and provide help in formulating falsifiable hypotheses, whether intuitive or not. In this view, the only way to judge the success of hypotheses is empirical tests.[4] To use an example from Milton Friedman, if a theory that says that the behavior of the leaves of a tree is explained by their rationality passes the empirical test, it is seen as successful.

However, it may not be possible to empirically test or falsify the rationality assumption, so that the theory leans heavily toward being a tautology (true by definition) since there is no effort to explain individual goals. Nonetheless, empirical tests can be conducted on some of the results derived from the models. In recent years the theoretical vision of rational choice theory has been subject to more and more doubt by the experimental results of behavioral economics. This criticism has encouraged many social scientists to utilize concepts of bounded rationality to replace the "absolute" rationality of rational choice theory: this points to the difficulties of data-processing and decision-making associated with many choices in economics, political science, and sociology. More economists these days are learning from other fields, such as psychology, in order to get a more accurate view of human decision-making than offered by rational choice theory. For example, the behavioral economist and experimental psychologist Daniel Kahneman won the Nobel Memorial Prize in Economic Sciences in 2002 for his work in this field.

Because of the relative success of economics at understanding markets, rational choice theory has also become increasingly employed in social sciences other than economics, such as sociology and political science in recent decades.[5] It has had far-reaching impacts on the study of political science, especially in fields like the study of interest groups, elections, behaviour in legislatures, coalitions, and bureaucracy.[6] Models that rely on rational choice theory often adopt methodological individualism, the assumption that social situations or collective behaviors are the result of individual actions alone, with no role for larger institutions.[7] The poor fit between this and sociological conceptions of social situations partially explains the theory's limited use in sociology. Among other things, sociology's emphasis on the determination of individual tastes and perspectives by social institutions conflicts with rational choice theory's assumption that our tastes and perspectives are given and inexplicable.

Contents |

Actions, assumptions, and individual preferences

The basic idea of rational choice theory is that patterns of behavior in societies reflect the choices made by individuals as they try to maximize their benefits and minimize their costs. In other words, people make decisions about how they should act by comparing the costs and benefits of different courses of action. As a result, patterns of behavior will develop within the society that result from those choices.

The idea of rational choice, where people compare the costs and benefits of certain actions, is easy to see in economic theory. Since people want to get the most useful products at the lowest price, they will judge the benefits of a certain object (for example, how useful is it or how attractive is it) compared to similar objects. Then they will compare prices (or costs). In general, people will choose the object that provides the greatest reward at the lowest cost.

| Part of a series on |

| Utilitarianism |

|---|

|

Predecessors

|

|

Types of utilitarianism

|

|

Key concepts

|

|

Related topics

|

| Politics portal |

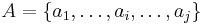

Rational decision making entails choosing an action given one's preferences, the actions one could take, and expectations about the outcomes of those actions. Actions are often expressed as a set, for example a set of j exhaustive and exclusive actions:

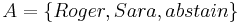

For example, if a person is to vote for either Roger or Sara or to abstain, their set of possible voting actions is:

Individuals can also have similar sets of possible outcomes.

Rational choice theory makes two assumptions about individuals' preferences for actions:

- Completeness – all actions can be ranked in an order of preference (indifference between two or more is possible).

- Transitivity – if action a1 is preferred to a2, and action a2 is preferred to a3, then a1 is preferred to a3.

Together these assumptions form the result that given a set of exhaustive and exclusive actions to choose from, an individual can rank them in terms of his preferences, and that his preferences are consistent.

An individual's preferences can also take forms:

- Strict preference occurs when an individual prefers a1 to a2, but not a2 to a1.

- In some models, a weak preference can be held in which an individual has a preference for at least aj, similar to the mathematical operator ≤.

- Indifference occurs when an individual does not prefer a1 to a2, or a2 to a1.

In more complex models, other assumptions are often incorporated, such as the assumption of independence axiom. Also, with dynamic models that include decision-making over time, time inconsistency may affect an individual's preferences.

Other assumptions

It is often claimed that rational choice theory makes some unrealistic assumptions in order to generate tractable and testable predictions. These can include:

- An individual has full or perfect information about exactly what will occur due to any choice made. More complex models rely on probability to describe outcomes.

- An individual has the cognitive ability and time to weigh every choice against every other choice. Studies about the limitations of this assumption are included in theories of bounded rationality.

Even more realistic theories of human action include such components as Amos Tversky and Daniel Kahneman's prospect theory, which reflects the empirical finding as that, contrary to rational choice theory, individuals attach extra value to items that they already own compared to similar items owned by others. To rational choice theory, the amount that an individual is willing to pay for an item (such as a drinking mug) should equal the amount he or she is willing to be paid in order to part with it. In experiments, the former price is typically significantly higher than the latter. Behavioral economics has added a large number of other amendments to our picture of human behavior that go against pure economic rationality.

Utility maximization

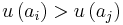

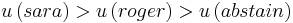

Often preferences are described by their utility function or payoff function. This is an ordinal number an individual assigns over the available actions, such as:

The individual's preferences are then expressed as the relation between these ordinal assignments. For example, if an individual prefers the candidate Sara over Roger over abstaining, their preferences would have the relation:

Criticism

Both the assumptions and the behavioral predictions of rational choice theory have sparked criticism from various camps. As mentioned above, some economists have developed models of bounded rationality, which hope to be more psychologically plausible without completely abandoning the idea that reason underlies decision-making processes. Other economists have developed more theories of human decision-making that allow for the roles of uncertainty, institutions, and determination of individual tastes by their socioeconomic environment (cf. Fernandez-Huerga, 2008).

Martin Hollis and Edward J. Nell's 1975 book offers both a philosophical critique of neo-Classical economics and an innovation in the field of economic methodology. Further they outlined an alternative vision to neo-Classicism based on a rationalist theory of knowledge. DON C. LAVOIE (1977, p. 325) argued that

To the devastating critiques of positivism by such philosophers as Brand Blanshard, W. V. Quine, S. Toulmin, A. R. Lousch and Karl Popper, can now be added that of Professors Hollis and Nell.lll The reason for the impotence of modern economics, these authors show, lies in its method. The rejuvenation of economics necessitates developing a different methodology, one which pays attention to the aspects of social sciences which distinguish them from natural sciences. We need a method which recognizes that people are not atoms and that society is not a laboratory.

Hollis and Nell (1975) dissect the textbook combination of neo-Classicism and Positivism, so crucial to the defence of orthodox economics against now-familiar objections. Within Neo-classicism, the authors addressed consumer behaviour (in the form of indifference curves and simple versions of revealed preference theory) and marginalist producer behaviour in both product and factor markets. Both are based on rational optimizing behaviour. They consider imperfect as well as perfect markets since neo-classical thinking embraces many market varieties and disposes of a whole system for their classification. However, the authors believe that the issues arising from basic maximizing models have extensive implications for econometric methodology (Hollis and Nell, 1975, p. 2). In particular it is this class of models – rational behavior as maximizing behaviour – which provide support for specification and identification. And this, they argue, is where the flaw is to be found. Hollis and Nell (1975) argued that Positivism (broadly conceived) has provided neo-Classicism with important support, which they then show to be unfounded. But we shall argue that they base their critique of neo-Classicism not only on their critique of Positivism but also on the alternative they propose, Rationalism.[8] Indeed, they argue that rationality is central to neo-Classical economics – as rational choice – and that this conception of rationality is misused. Demands are made of it that it cannot fulfil.[9]

In their 1994 work, Pathologies of Rational Choice Theory, Green and Shapiro argue that the empirical outputs of rational choice theory have been limited. They contend that much of the applicable literature, at least in Political Science, was done with weak statistical methods and that when corrected many of the empirical outcomes no longer hold. When taken in this perspective, Rational Choice Theory has provided very little to the overall understanding of political interaction - and is an amount certainly disproportionately weak relative to its appearance in the literature. Yet, they concede that cutting edge research, by scholars well-versed in the general scholarship of their fields (such as work on the U.S. Congress by Keith Krehbiel, Gary Cox, and Mat McCubbins) has generated valuable scientific progress.[10]

Duncan Foley (2003, p. 1) has also provided an important critic of the concept of Rationality and its role in Economics. He argued that

“Rationality” has played a central role in shaping and establishing the hegemony of contemporary mainstream economics. As the specific claims of robust neoclassicism fade into the history of economic thought, an orientation toward situating explanations of economic phenomena in relation to rationality has increasingly become the touchstone by which mainstream economists identify themselves and recognize each other. This is not so much a question of adherence to any particular conception of rationality, but of taking rationality of individual behavior as the unquestioned starting point of economic analysis.

Foley (2003, p. 9) went on to argue that

The concept of rationality, to use Hegelian language, represents the relations of modern capitalist society one-sidedly. The burden of rational-actor theory is the assertion that “naturally” constituted individuals facing existential conflicts over scarce resources would rationally impose on themselves the institutional structures of modern capitalist society, or something approximating them. But this way of looking at matters systematically neglects the ways in which modern capitalist society and its social relations in fact constitute the “rational”, calculating individual. The well-known limitations of rational-actor theory, its static quality, its logical antinomies, its vulnerability to arguments of infinite regress, its failure to develop a progressive concrete research program, can all be traced to this starting-point.

Schram and Caterino (2006) contains a fundamental methodological criticism of rational choice theory for promoting the view that the natural science model is the only appropriate methodology in social science and that political science should follow this model, with its emphasis on quantification and mathematization. Schram and Caterino argue instead for methodological pluralism. The same argument is made by William E. Connolly, who in his work Neuropolitics shows that advances in neuroscience further illuminate some of the problematic practices of rational choice theory.

More recently Edward J. Nell and Karim Errouaki (2011, Ch. 1) argued that:

The DNA of neo-Classical economics is defective. Neither the Inductive Problem, nor the problems of Methodological Individualism can be solved within the framework of neoclassical assumptions. The neo-Classical approach is to call on Rational Economic Man to solve both. Economic relationships that reflect Rational choice should be ‘projectible’. But that attributes a deductive power to ‘rational’ that it cannot have consistently with Positivist (or even Pragmatist) assumptions (which require deductions to be simply analytic). To make rational calculations projectible, the agents may be assumed to have idealized abilities, especially foresight; but then the Inductive Problem is out of reach because the agents of the world do not resemble those of the model. The agents of the model can be abstract, but they cannot be endowed with powers actual agents could not have. This also undermines Methodological Individualism; if behaviour cannot be reliably predicted on the basis of the ‘rational choices of agents’ a social order cannot reliably follow from the choices of agents.

Furthermore, Pierre Bourdieu fiercely opposed Rational Choice Theory as grounded in a misunderstanding of how social agents operate. Bourdieu argued that social agents do not continuously calculate according to explicit rational and economic criteria. According to Bourdieu, social agents operate according to an implicit practical logic—a practical sense—and bodily dispositions. Social agents act according to their "feel for the game" (the "feel" being, roughly, habitus, and the "game" being the field).[11]

Benefits

Describing the decisions made by individuals as rational and utility maximizing may seem to be a tautological explanation of their behavior that provides very little new information. While there may be many reasons for a rational choice theory approach, two are important for the social sciences. First, assuming humans make decisions in a rational, rather than a stochastic manner implies that their behavior can be modeled and thus predictions can be made about future actions. Second, the mathematical formality of rational choice theory models allows social scientists to derive results from their models that may have otherwise not been seen, and submit these theoretical results for empirical verification. Despite these benefits, there is nothing about rational choice theory that tells scholars that they should reject other methods of investigating questions about the economy and society, such as the sociological determination of individual tastes.

See also

- Analytic narrative

- Bureaucracy

- Choice theory

- Decision theory

- Decision making software

- Efficient market hypothesis

- Framing (social sciences)

- Homo economicus

- James S. Coleman

- Game Theory

- Gerard Debreu

- Neoclassical economics

- Organizational theory

- Phronetic theory

- Positive political theory

- Public choice theory

- RAND Corporation

- Rational expectations

- Rational ignorance

- Rational pricing

- Rationality

- Rationality and power

- Social choice theory

- Theory of religious economy (an application of the rational choice theory as a theory of religion)

- Vicarious problem solving

- Parametric determinism

References

- Abella, Alex (2008). Soldiers of Reason: The RAND Corporation and the Rise of the American Empire. New York: Harcourt.

- Allingham, Michael (2002). Choice Theory: A Very Short Introduction, Oxford.

- Amadae, S.M.(2003). Rationalizing Capitalist Democracy: The Cold War Origins of Rational Choice Liberalism, Chicago:University of Chicago Press.

- Arrow, Kenneth J. ([1987] 1989). "Economic Theory and the Hypothesis of Rationality," in The New Palgrave: Utility and Probability, pp. 25-39.

- Bicchieri, Cristina (1993). Rationality and Coordination. Cambridge University Press

- Bicchieri, Cristina (2003). “Rationality and Game Theory”, in The Handbook of Rationality, The Oxford Reference Library of Philosophy, Oxford University Press.

- Downs, Anthony (1957). "An Economic Theory of Democracy." Harper.

- Coleman, James S. (1990). Foundations of Social Theory

- Elster, Jon (1979). Ulysses and the Sirens, Cambridge University Press.

- Elster, Jon (1989). Nuts and Bolts for the Social Sciences, Cambridge University Press.

- Elster, Jon (2007). Explaining Social Behavior - more Nuts and Bolts for the Social Sciences, Cambridge University Press.

- Fernandez-Huerga (2008.) The Economic Behavior of Human Beings: The Institutionalist//Post-Keynesian Model" Journal of Economic Issues. vol. 42 no. 3, September.

- Schram, Sanford F. and Brian Caterino, eds. (2006). Making Political Science Matter: Debating Knowledge, Research, and Method. New York and London: New York University Press.

- Sen, Amartya (1987). [2008]. “Rational behaviour," The New Palgrave: A Dictionary of Economics, v. 3, pp. 68-76. Abstract.

- Walsh, Vivian (1996). Rationality, Allocation, and Reproduction, Oxford. Description and scroll to chapter-preview links.

- Martin Hollis and Edward J. Nell (1975) Rational Economic Man. Cambridge: Cambridge University Press.

- Foley D. K (1989) Ideology and Methodology. An unpublished lecture to Berkeley graduate students in 1989 discussing personal and collective survival strategies for non-mainstream economists.

- Foley, D.K (1998). Introduction (chapter 1) in Peter S. Albin, Barriers and Bounds to Rationality: Essays on Economic Complexity and Dynamics in Interactive Systems. Princeton: Princeton University Press.

- Foley, D. K (2003) Rationality and Ideology in Economics. lecture in the World Political Economy course at the Graduate Faculty of New School UM, New School.

- Boland, L. (1982) The Foundations of Economic Method.London: George Allan & Unwin

- Edward J. Nell and Errouaki, K. (2011) Rational Econometric Man. Cheltenham: E.Elgar.

- Pierre Bourdieu (2005) The Social Structures of the Economy, Polity 2005

- Calhoun, C. et al. (1992) "Pierre Bourdieu: Critical Perspectives." University of Chicago Press.

- Grenfell, M (2011) "Bourdieu, Language and Linguistics" London, Continuum.

- Grenfell, M. (ed) (2008) "Pierre Bourdieu: Key concepts" London, Acumen Press

Notes

- ^ Lawrence E. Blume and David Easley (2008). "rationality," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract & pre-publication copy (press +).

- ^ Peter Hedström and Charlotta Stern (2008). "rational choice and sociology," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

- ^ Gary S. Becker (1976). The Economic Approach to Human Behavior. Chicago. Description and scroll to chapter-preview links.

- ^ a b Milton Friedman (1953), Essays in Positive Economics, pp. 15, 22, 31.

- ^ Scott, John. "Rational Choice Theory". http://privatewww.essex.ac.uk/~scottj/socscot7.htm. Retrieved 2008-07-30.

- ^ Dunleavy, Patrick (1991). Democracy, Bureaucracy and Public Choice: Economic Models in Political Science. London: Pearson.

- ^ Elster, Jon (1989). Nuts and Bolts for the Social Sciences. Cambridge University Press.

- ^ For an in-depth examination of rationality and economic complexity see Foley (1998). For an account of rationality, methodology and ideology see Foley (1989, 2003).

- ^ Somewhat surprisingly and independently, Hollis and Nell (1975) and Boland (1982) both use a ‘cross sectional approach’ to the understanding of neo-classical economic theory and make similar points about the foundations of neo-classicism. For an account see Nell, E.J. and Errouaki, K (2011)

- ^ Donald P. Green and Ian Shapiro (1994). Pathologies of Rational Choice Theory: A Critique of Applications in Political Science. Yale University Press.

- ^ For an account of Bourdieu work see the wikipedia article on Pierre Bourdieu. See also Pierre Bourdieu (2005) The Social Structures of the Economy, Polity 2005.

External links

- Rational Choice Theory at the Stanford Encyclopedia of Philosophy

- Rational Choice Theory - Article by John Scott

- What Is Neoclassical Economics at Post-Autistic Economics Review

- The New Nostradamus - on the use by Bruce Bueno de Mesquita of rational choice theory in political forecasting

- To See The Future, Use The Logic Of Self-Interest - NPR audio clip